Minister of Finance and Economic Affairs Simplex Chithyola-Banda on Friday presented the 2024/25 National Budget in parliament to run from April 1st 2024 to March 31st 2025.

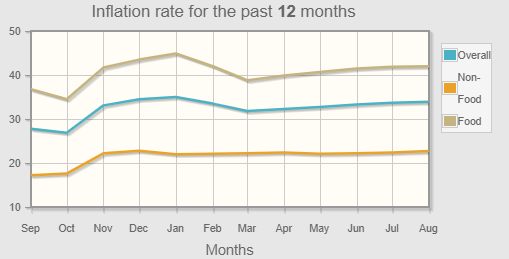

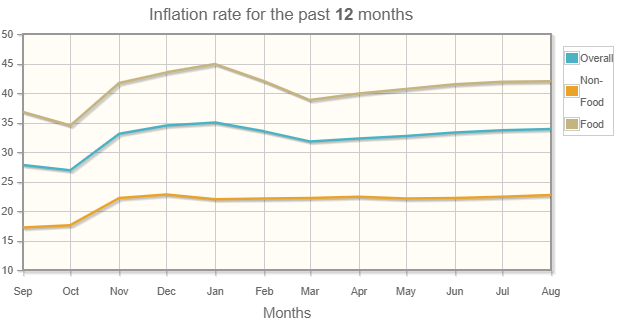

The proposed K5.98 trillion National Budget is built on the assumption that the economy will grow by 3.6 percent and inflation will moderate to 23.4 percent from the current 35 percent.

The budget projects K4.55 trillion in revenue, which is 49 percent higher than in 2023/24, but galloping spending pressures amid unsustainable debt burdens leaves little room in the resource envelope to operate, especially in a volatile economic situation.

Recurrent expenditures are projected at K4.21 trillion, representing 22.5 percent of gross domestic product (GDP) and 70.4 percent of total expenditure.

Treasury has boldly adjusted development expenditure by 63 percent from K1.08 trillion in the 2023/24 financial year to K1.77 trillion in the current fiscal plan although pressure to increase existing construction contract prices following the 44 percent kwacha devaluation may also have spurred the jump.

The proposed 2024/2025 financial plan’s overall balance is estimated at a deficit of K1.43 trillion, which is 7.6 percent of GDP.

Chithola-Banda also outlined new tax measures meant to cushion low-income earners grappling with the cost of living crisis while broadening the tax net.

According to the Minister, effective April 1 2024, the zero pay as you earn (Paye) bracket will be increased from K100 000 to K150 000.

Accordingly, the next K350 000 will be taxed at 25 percent while the next K2 050 000 will be taxed at 30 percent and K2 550 000 will be taxed at 35 percent.

He said: “To cushion employees in formal employment from the effects of the currency alignment, the government has increased the zero-Paye bracket from K100 000 to K150 000.”

The zero tax free band comes amid piling pressure on the Ministry of Finance and Economic Affairs to increase the zero-tax band in the 2024/25 National Budget as consumers seek relief from a cost of living crisis that has eroded their purchasing power.

The proposals are a deviation from the tax schedule announced in the 2023/24 National Budget Statement which came into effect on April 1 last year and maintained the zero-rated tax band at K100 000, but revised other tax brackets with incomes between K100 001 and K330 000 taxed at 25 percent.

Meanwhile, Chithyola-Banda indicated that recognizing the assistance the private sector provides to people who have been affected by various calamities in the country, government will allow 100 percent deductions for monetary donations to calamities made through the Department of Disaster Management and 50 percent deduction on the cost of a private sector-drilled borehole.

Treasury has also reduced withholding tax for mobile money agents from 20 percent to one percent to align with the prevailing withholding tax rate for banks and insurance agents.

“In addition, most of the mobile money agents do not make enough money to pay personal income tax as their income falls below the minimum threshold of paying personal income tax,” he said.

As one way of promoting the use of locally sourced raw materials for production and promoting farmers, Treasury has announced the reduction of excise tax on clear beer made from sorghum and maize from 40 percent to 20 percent.

Treasury has also extended the removal of import duties and taxes to electric motorcycles.

To align with the 15 percent tax rate on investment of pension funds, government has reduced the withholding tax on interest realized from investments of life assurance from 20 percent to 15 percent.

According to Chithyola-Banda, the 15 percent income tax rate on pension funds will only apply on the return on investment of pension funds and not on the income of the Pension Fund Managers which attracts 30 percent corporate income tax.

To address student accommodation challenges in tertiary education institutions, Chithyola-Banda said government will waive import duty and import excise tax on building materials, furniture, and fittings specifically for the construction of tertiary education students’ hostels.

To encourage value addition and promote local manufacturing, government will allow the Malawi Army, Malawi Police Service and Malawi Prisons Service to import duty-free fabrics and accessories for making uniforms.

However, Treasury will increase import duty on finished iron sheets of tariff subheading 7210.49.90 from 15 to 20 percent, sacks of tariff subheading 6305.33.00 from 20 to 25 percent and introduce a surcharge of 10 percent on sacks for cement packaging.

To align with the taxation of other petroleum products such as petrol, paraffin and diesel, import duty has been increased from 20 percent while import excise duty of 10 percent has been introduced on automotive lubricants.

Treasury has also introduced import duty of five percent and exercise duty of 10 percent on airplanes and other aircraft of un-laden weight exceeding 2 000 kilogrammes (kg) but not exceeding 15 000 kg. Petroleum jelly will also attract excise tax of 10 percent.

Meanwhile, the 10 percent corporate income tax on profits above K10 billion, which Treasury effected on banks has been extended to all businesses that make such profits to ensure equal and fair treatment of ‘super normal profits’.

Malawi Confederation of Chambers of Commerce and Industry (MCCCI) president Lekani Katandula has described the tax policy measures as a “mix” of measures.

The assumption that profits above K10 billion are automatically ‘super normal’ regardless of how much is invested in the enterprise is not well thought through, he said.

Meanwhile, a review of the comparative corporate tax rates shows that Malawi rates will be the highest within SADC, with figures showing rates in member countries hovering around 30 percent.

“This will undermine our desire to attract Foreign Direct Investment into Malawi. It could also motivate some multi nationals to adopt transfer pricing policies that shift profits from Malawi to lower tax regimes to the detriment of both our tax collections and forex preservation,” observed Katandula.