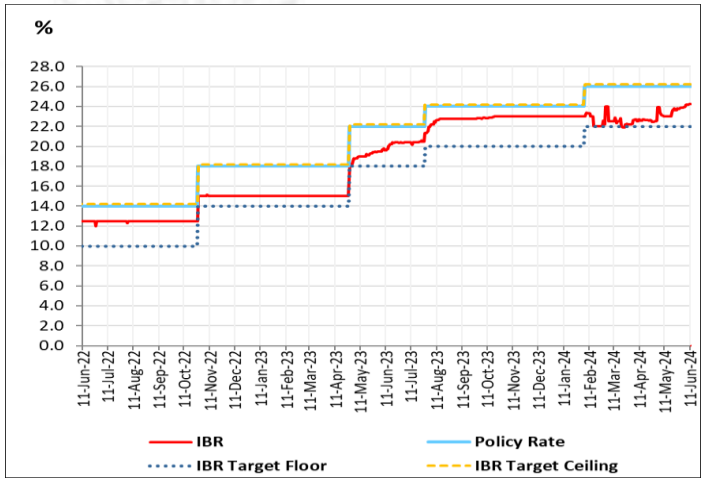

Commercial banks have raised the reference rate by 0.1 percentage point to 25.1 percent in June from 25 percent in May, published statements show.

This is the second time commercial banks have hiked their reference rate, an interest rate benchmark used to set other interest rates, from 24.9 percent between January and April to 25 percent in May.

Such increases in the reference rate have led to high interest rates for both industries and individuals.

During the recent Monetary Policy Committee (MPC) meeting the Reserve Bank of Malawi (RBM) maintained the policy rate at 26 percent but raised the Liquidity Reserve Ratio (LRR) for domestic currency deposits by 100 basis points to 8.75 percent.

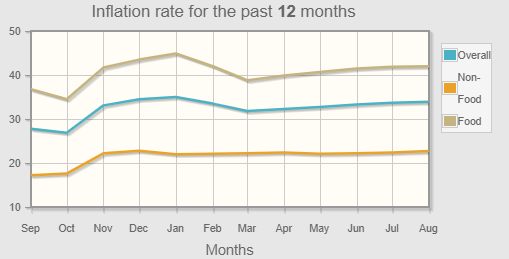

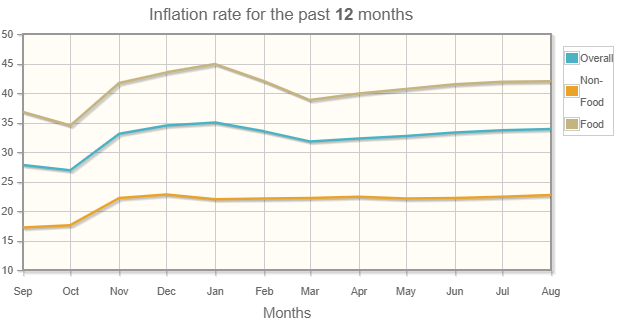

In arriving at this decision, the MPC said it took into account the recent deceleration in inflation and its continued downward projected trend in the near term.

However, the Committee said it noted that there are upside risks to the inflation outlook, including the projected lower crop harvest, high money supply growth and higher global oil prices.

Malawi Confederation of Chambers of Commerce and Industry (MCCCI) President Wisely Phiri earlier pointed the increase in LRR would adversely affect credit availability for businesses.

He said the high cost of borrowing which goes hand in hand with changes in policy rate has led to a significant decline in growth of private sector credit.

“The rise in LRR will force some banks to purchase temporary liquidity from the Reserve Bank which in turn will raise their costs. These costs will be passed to borrowers through increased interest rates. Further increases in the cost of borrowing and impacting on the levels of lending activities to the private sector.

“Businesses cannot expand without reasonably priced credit and this decline in private sector credit will lead to a decline in the level of investments which ultimately is costly to the economy in the medium to long term,” said Phiri.

Meanwhile, RBM has forecast 2024 annual inflation at 30 percent and upside risks to the inflation outlook.