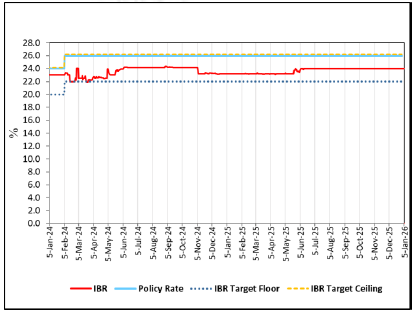

Commercial banks have announced a slight adjustment to the reference rate, revising it downwards from 25.3 percent to 25.2 percent.

The reference rate, which serves as the benchmark for determining lending rates across the banking sector, is reviewed monthly in line with prevailing market conditions and monetary policy signals.

The latest revision reflects efforts to align borrowing costs with current liquidity trends and inflationary pressures in the economy.

Financial analysts note that while the adjustment is marginal, it signals cautious optimism within the banking sector.

A lower reference rate could ease the cost of credit for businesses and individuals, potentially stimulating investment and consumption. However, the impact is expected to be modest given the broader challenges of high inflation and foreign exchange shortages that continue to weigh on the economy.

The revision comes at a time when policymakers are emphasizing fiscal discipline and structural reforms to stabilize the macroeconomic environment.

Stakeholders in the private sector will be watching closely to see whether further reductions in lending rates follow, as access to affordable credit remains a critical factor for growth and competitiveness.